RiskInsight

Find future high-cost claimants.

Underwrite the future, not the past.

Predict high-cost claimants at the individual and group level to fuel stop-loss underwriting decisions that grow your business.

Who needs RiskInsight?

For underwriters

- Complement your market knowledge and help triangulate price

- Increase your stop-loss margins

- Grow your stop-loss business

- Price competitively

Why you need RiskInsight

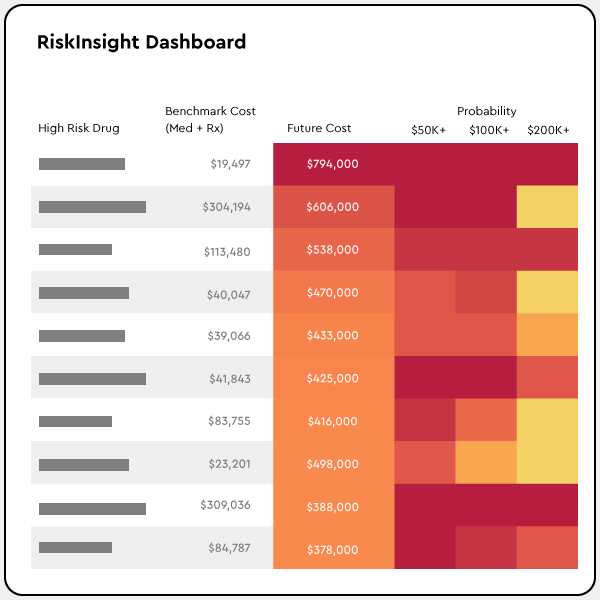

AI tailored to your unique populations provides detailed insights into diagnoses and prescriptions driving future cost predictions. This enables you to accurately project high-cost and low-cost member risk for more competitive pricing.

Identify future high-cost claimants

Identify high-cost claimants and their future dollar value, at the individual and group level. That means better insights, more competitive pricing, and more revenue for you.

Grow stop-loss margins

Price your products more competitively with highly precise high-cost claimant projections that secure your renewals and drive new business — across all self-funded groups.

Increase accuracy and trust

Get predictions that are up to twice as accurate as any other solution — especially during atypical utilization periods like a pandemic

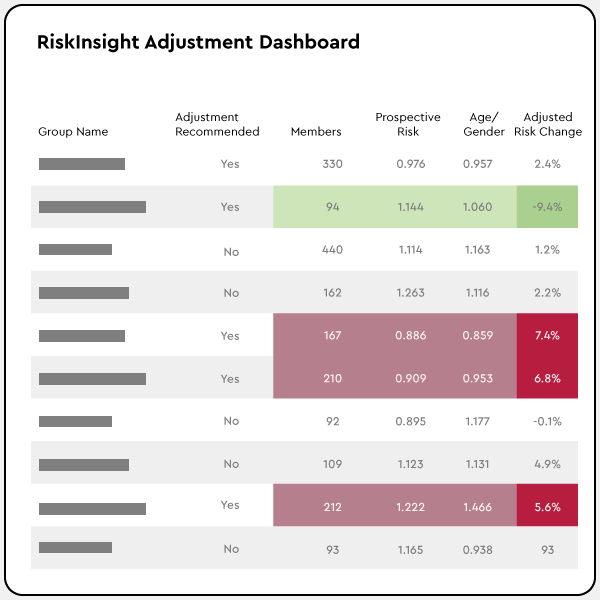

Protect yourself from regression to the mean

Find patterns undetectable to the human eye, so that you don't overprice groups whose risk will go down or underprice groups whose risk will go up. That means you can offer the most competitive rate to your book.

Optimize workflows

Support the underwriting workflow through a standalone tool or seamless integration with existing workflows.

Results

Better

Visibility

$43m

Uncovered over $43 million in previously undetected future high-cost claimants

Proactive

Management

$68M

Identified $68M more stop loss dollars that were missed by other tools

Identify

More

20%

A 20% increased capture of future risk across major condition categories

How RiskInsight works

RiskInsight reveals hidden member-level insights into future high-cost and low-cost claimants that would otherwise be missed by relying on experience alone. Our advanced AI solution also identifies diagnostic and prescription indicators of future risks at the member level. By find previously unidentified high-cost claimants even without incurred claims, and providing future point estimates, RiskInsight supports underwriter triangulation to price stop loss competitively, grow margin, and win new business.

- Enables group level risk allocation

- Insight into individual changes in costs allows for more protection from data gaps, regression to the mean and unseen new high cost

- Insight into previously unidentifiable high-cost claimants and future point estimates and likelihoods on high-cost claimants

What our customers say

"With the help of Prealize, we were able to expect what could have been unexpected"

Underwriter, Large Blues Plan

"We are looking to the future instead of the past."

SVP, Underwriting, Large Blues Plan

"Prealize helps me identify a high future risk on a renewal that allows me to more appropriately rate the risk."

Underwriter, Large Blues Plan

Case Study: RiskInsight

This large regional health plan serves more than 2 million people, from individuals and families to employees of Fortune 100 companies.

Discover how Prealize helped the client to uncover 14% more future high-cost claimants.