Unlocking the True Potential of Stop-Loss with Threshold Predictions: A Game-Changer in Risk Management

In the world of healthcare, stop-loss is a crucial tool for managing risk. It acts as a safety net, providing protection when a group’s claims exceed a predetermined threshold. Traditionally, stop-loss projections have relied heavily on rules-based risk scores and other manual underwriting methods to predict future claims and costs and set premiums. While accurate risk scores provide valuable insights into a group’s potential risk, they only tell part of the story. To more accurately assess risk and set premiums, it’s essential to understand not just the risk, but also the thresholds that determine where a group’s claims will cross critical cost levels.

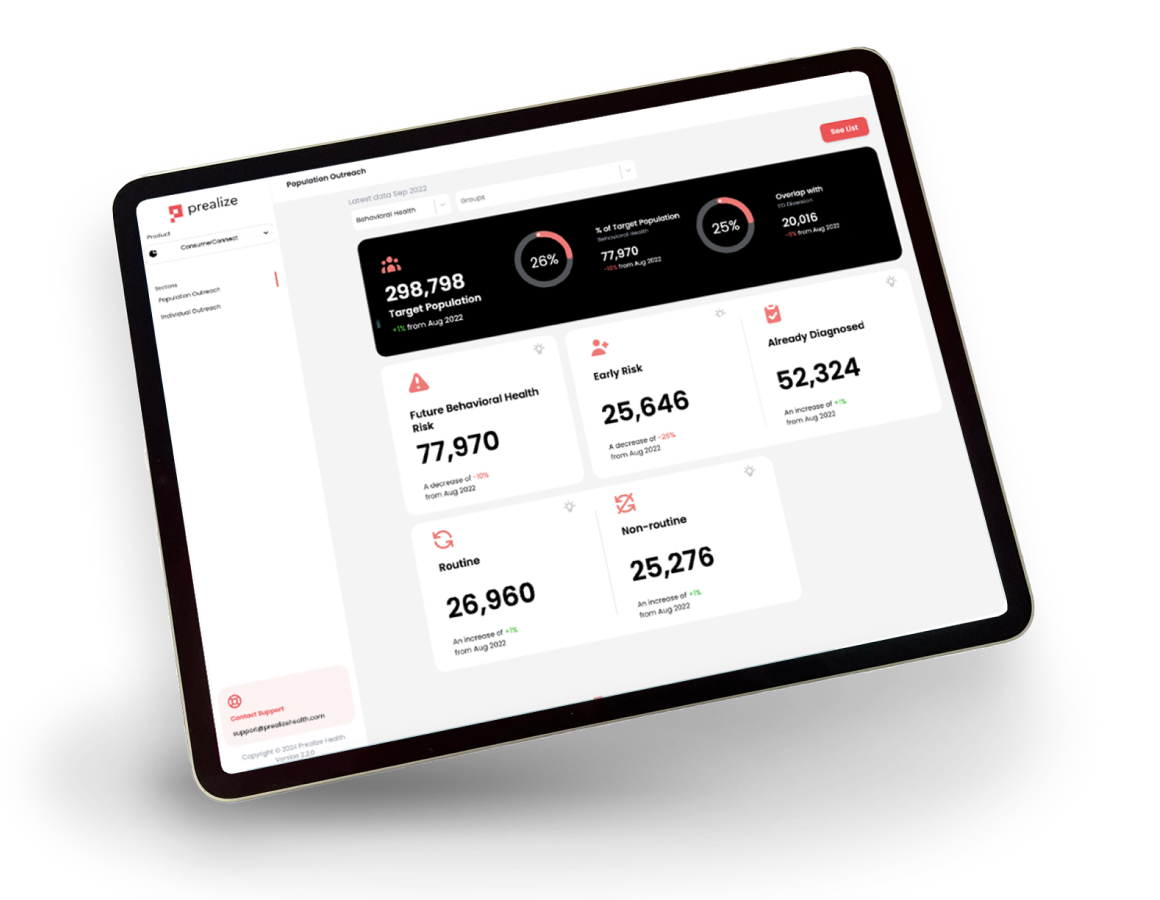

At Prealize Health, we believe in going beyond traditional methods. We are revolutionizing the way stop-loss underwriting is done by using advanced AI to develop more accurate risk scores as well as providing accurate threshold predictions. This innovation is making it possible to not only assess the risk better, but to also predict how many members will cross certain cost thresholds and how much excess cost the group will have at each threshold.

Why Thresholds Matter in Stop-Loss Projections

Risk scores alone are useful, but they don’t provide enough actionable data to assess stop-loss. Risk scores estimate the relative risk of claims expense, but they fall short in predicting when and how those claims will materialize within a given timeframe.

By predicting the number of members who will exceed specific cost thresholds, our solution offers far more precision. We can forecast the number of members per cost threshold that will exceed these limits in a future 12-month period. This enables health plans and self-insured employers to more accurately estimate their financial risk and tailor their stop-loss strategies accordingly.

For example, in a recent case study with a $516M premium, our solution identified $32 million more in stop-loss savings than traditional claims experience analysis. When compared to other predictive models, we identified $20 million more in potential savings. This demonstrates just how much more value can be gained when you predict the thresholds at which claims are likely to hit, rather than relying solely on risk scores.

The Power of Predicting Thresholds

By accurately predicting the threshold at which a group’s claims will exceed certain cost levels, we provide organizations with a stronger understanding of their potential liabilities. This goes beyond simple risk evaluation and allows for proactive management of stop-loss coverage, ensuring that the appropriate levels of protection are in place to prevent financial stress.

Here’s how threshold predictions make a difference:

- Enhanced Risk Mitigation: When paired with our cost containment predictions, predictive thresholds help identify when claims may exceed limits, enabling proactive interventions to reduce the impact of spiraling costs.

- Data-Driven Strategy: Access to predictive data allows insurers to make informed decisions, refine risk management approaches, and optimize stop-loss underwriting.

- Cost Control: Early detection of high-risk claims prevents financial surprises, keeping claim costs manageable and improving overall plan performance.

Conclusion

When it comes to stop-loss, relying solely on risk scores is no longer sufficient. To truly optimize your stop-loss strategy, it’s crucial to understand the thresholds claims are likely to exceed. Prealize’s innovative use of predictive analytics enables you to forecast these thresholds with greater accuracy, offering deeper insights and enhanced savings. By combining predictive risk analytics with threshold forecasting, we’re setting a new standard in stop-loss management.

To learn more about how Prealize Health is revolutionizing stop-loss, contact us today. Let us help you unlock the full potential of your stop-loss strategy!

Experience the Prealize Difference

We invite you to experience the transformative power of unparalleled accuracy. Request a demo today and see how Prealize can empower your organization to achieve better health outcomes, reduced costs, and a new era or proactive care.